The Two Main Terminology Areas of Maintenance in HOAs

Maintenance is a big part of HOAs and a critical pillar for successful HOA operations. Maintenance must be paid for by the HOA. The classification of expenses for maintenance involves understanding the nature of and type of expense being paid. This falls into two areas.

The net effect to the HOA is the same on both categories–the HOA covers the cost. The tracking, reporting, and how these are assessed to and paid by owners of HOAs can vary. General maintenance expenses are compared with these categories which can be found in Exhibit 5.1.

Completing HOA-mandated maintenance involves working with trusted vendors first and foremost. With this comes several considerations and requirements to ensure the HOA is complying with the CC&Rs and best practices.

Key Vendor Factors for Successful Project Completion

| Size Matter |

| Ensure that the vendor has proper professionals to complete your project. Some vendors may subcontract out work and the HOA needs to know this as part of the selection process. |

| Expertise in Immediate Project Need |

| On occasion, vendors may take on work that they are not truly qualified for but believe they can perform as a general contractor. Ask for specific project examples–pictures or website testimonials to gain comfort on immediate project experience. |

| References for Person or Projects |

| For large-scale projects, it is common to request references for similar projects, persons, or locations to help the HOA evaluate and decide. |

| Licensed |

| In some states, vendors may be required to be licensed to perform projects. Ensure that licensing is in place and current when required. Check with vendors and state laws if you’re unclear if your project may require licensing. |

| Contracts |

| Have a written contract in place. This should cover the project scope of work, warranties, timing, and payment at the minimum. This is very important to clarify items and avoid issues that may arise later. |

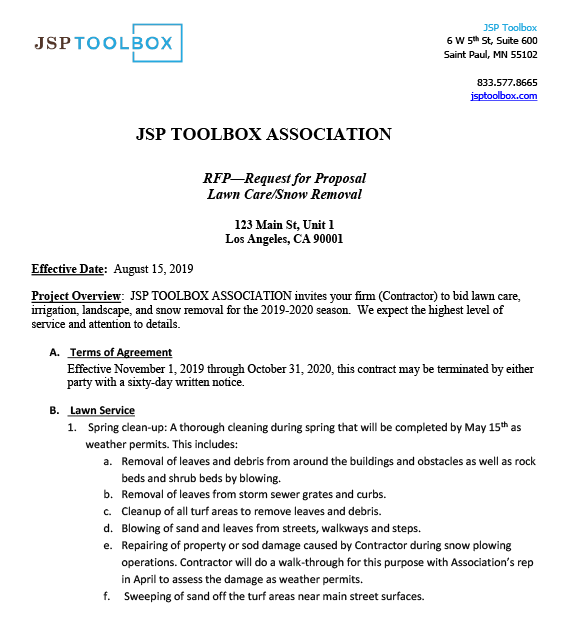

Insurance

Verify that the vendor maintains insurance to comply with the HOA coverage requirements. This may require items from the sample coverage table below. Always confirm with the HOA master insurance what the HOA should receive. An example is included in Exhibit 5.2.

Communication Style

Vendors tend to prefer to deal with one representative of an HOA.

-

- Assign one HOA representative to communicate with the lead vendor person. This HOA assigned person provides owners notices of work activity as provided by the vendor and responds to owner questions.

- Any change orders for project, issues, items, questions, or related requiring Board or HOA approval are first raised by the vendor to the HOA assigned person.

- Avoid permitting owners to directly contact vendor personnel while performing project work; this can cause confusion, delays, and unnecessary attention.

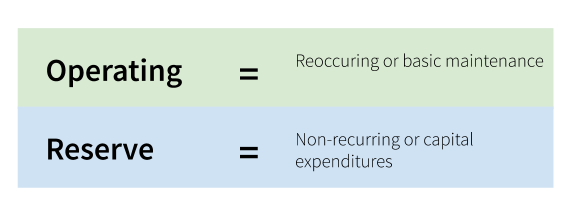

Request for Proposal (RFP)

Collecting RFPs for a project helps you compare pricing and service from vendors. A best practice is for HOAs to draft specific requirements for a project that they want and need a vendor to perform on to earn the business of the HOA. This is accomplished commonly through an RFP, in which an example can be found in Exhibit 5.3 or within the ‘HOA Forms & Templates’ section of JSP Toolbox.

Evaluating Vendor Work

Making decisions and then evaluating vendor work are critical components for HOAs. The criteria for selecting vendors are discussed above in detail. RFPs are excellent tools to ensure the project is off to the right start and that both parties’ expectations are met. Once work commences, the next critical steps are to evaluate vendor work.

Best Practices to Evaluate Vendor Work

| Vendor communications on work, timeline, expectations, and needs of the HOA |

| This helps lay the groundwork for projects and assists the HOA in expectation management. Best vendors provide clear timing of work and ensure the HOA understands the desired outcomes. |

| Establish milestone completion |

| Depending on the extent of a project, including time-based project completion parts is a best practice to ensure the work is completed timely. |

| Avoid vendor interactions with HOA owners |

|

Vendors performing work that can impact or result in interactions must avoid discussions that can alter the project scope and parties. Cautionary note: HOA owners sometimes enjoy sidetracking vendors with questions, requests, or comments that do not reflect the approved HOA work. These can lead to compromised relations and deter from successful completion. |

| Communication can help overcome obstacles and unplanned items |

| Despite best intentions, projects can sometimes not go as planned–whether it be from third parties, events, or occurrences beyond a vendor’s control. How a vendor handles these is more telling than the actual issue at hand. Good vendors will communicate upfront to the HOA with the issue, how it is planned to be corrected, and what impacts this means to the overall project. |

| Complete punch list before final payment |

| At the end of many projects, the HOA and vendor review the work and if any items are needed. These comprise a punch list of items to be corrected before the final payment to the vendor is made. A best practice is to have this planned discussion upfront and part of the vendor contract to avoid delays at the end of the project. |

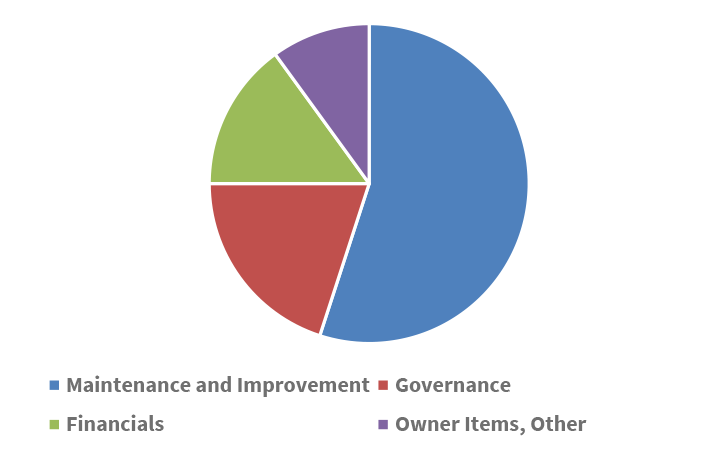

HOA Time

HOAs can spend, on average, between 50%-60% of their time on maintenance and improvement items. This may vary of course, but maintenance is a huge aspect of all HOAs. Many owners comment on what their HOA does for them and the responses largely rest around upkeep, repairs, and acting on needed maintenance items. The HOA must have a plan in place for maintenance and improvements – and further that owners understand where their money goes and for what. Sharing plans with owners creates transparency that enables owners to understand or at least obtain information on what it takes to operate an HOA and where most of the assessments are allocated for when it comes to maintenance and improvements.

There is no assurance that owners will support or be accepting of HOA plans. Pleasing all owners is rare, if not impossible. But many things done in HOAs are process-driven, rather than results-oriented. HOAs are not driven to limit or decrease maintenance spending to maximize profits. Quite the opposite–HOAs operate to ensure that HOA property is maintained and improved as needed. The process standpoint is permitting owners to share and be heard through service requests for work to be completed or to share input to the HOA on what they feel is important to the HOA property. Exhibit 5.1 is an example of a plain language description of items involving HOAs and maintenance and improvement spending.

Exhibit 5.1

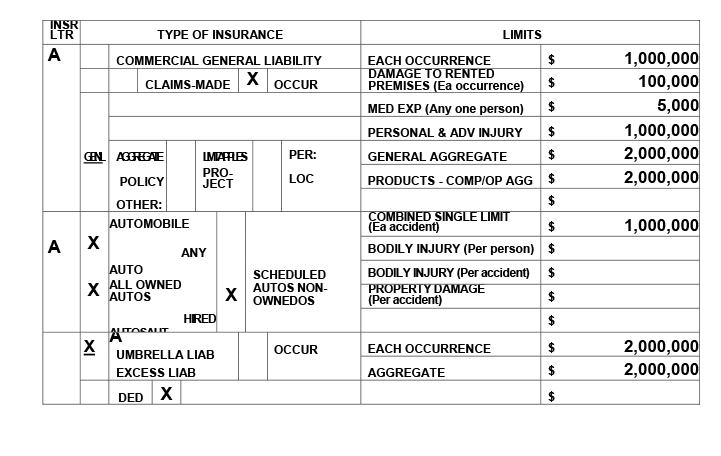

| Category | Operating | Reserve |

| What expenses go where? |

Annual budget expenses like:

|

Capital expenditures like:

|

| How are owners assessed costs? | Regular assessments made as part of the annual budget typically completed 2-3 months before the beginning of the HOA fiscal year. | A portion of regular assessment allocated to reserve contributions. Special assessments to ownership for specific projects/items made when needed with proper approval (as applicable per CC&Rs) by and advance notice to ownership. |

| How are costs paid? | HOA operating account (which is a checking account established in HOA’s name and tax identification number) used to pay bills. | HOA operating or reserve account. (reserve account for HOAs are generally no risk, interest-bearing savings accounts established to hold funds for reserve or capital projects). |

| Who determines where expenses go? | HOA CC&Rs define common elements and sometimes costs the HOA must pay to operate these items. Operating expenses would be those costs. |

HOA CC&Rs or Reserve Study. (reserve study is a detailed report generally prepared by professional engineers, architects, actuaries and related professionals for HOAs. This report is a valuable and, in some states, required tool. A typical reserve study report includes:

|

| When do owners have to pay these? | When the annual budget is approved. Regular assessments are technically and normally an annual charge, meaning owners pay one payment for 12 months. But for convenience and affordability for owners are payable ratably over fiscal year (12 months) typically due on or around the 1st business day of each calendar month. | When the annual budget is approved. For special assessments, typically a minimum of 30 days after approved and notice sent to owners. |

| How much can be charged to owners? |

Some HOA CC&RS limit the amount of regular assessment increase approved by the Board for each fiscal year by a percentage (i.e. 5% or 10% maximum increase) without obtaining ownership vote and approval. If there is no CC&R limit, the amount of increase is not limited. |

Same as Regular Assessment, but further some HOA CC&R only permit special assessments if owners vote and approve. On rare CC&R circumstances (particularly older HOAs), there is no provision for special assessments at all. If there is no CC&R limit, the amount of increase is not limited. |